CEO Memo - April 2023

Well, April is behind us for another year, with it being a funny four weeks. There have been a lot of changes with Web Wonks’ resourcing, as we continue to configure ourselves into a multi-franchise organisation.

The company formally began buying its labour from our (now) parent company, Web Wonks (US) Inc. The two entities are now referred to as NZ1 and US1, with US1 being the Master Franchise owner. We are in the process of building the US1 tech stack. Upon completion, we will set up TX1 (Texas franchise). This exercise involves significant financial investment and compliance procedures!

In the back half of the year, we will aim to have OpenAI set up in our US1 tenant ready for teaching the system how to respond to prompts by our clients. Ideally, we want you to get the best out of a range of benefits we can offer by blending different datasets that are relevant to your objectives. For example, asking “What has my ROAS been over the past 12 months”, or “Please send me a copy of my project plan”.

As much as I might not wish for it to, the expansion into the US will take longer. I can foresee that AI will be an important part of all businesses' futures, but privacy and data ownership are two concerns I currently have.

Client churn has stayed steady month-to-month all year, which is a great place to be. Leads have been challenging during April, but of course, we have had the Easter break, school holidays, a new financial year, and the recent 50 basis point increase in the OCR which looks likely to squeeze us all for another twelve months.

We bid farewell to two NZ1 project managers, Michael and Timmy. We wish them all the best with their next steps. This is part of a drive toward concentrating our most senior staff in New Zealand, and backhauling our labour component in the Philippines.

To top off the month I cracked my rib refereeing East Coast Bays vs Silverdale Premier Reserves on Good Friday. A player kicked down field and we all turned as one, but as I turned another player pulled his elbow back as he went to run and he smacked me right in the chest. That injury alone made the month suck, and it’s still troubling me.

I am travelling to Manila on the 9th of May to visit our wonderful Philippines team. It will be my first visit since 2019, so I am looking forward to seeing everyone in person. I have a busy itinerary which will include conducting reviews for all of the staff and hosting a company dinner. Judging by the weather there of late, it looks like I shall be in for some high temperatures.

If for nothing else, life isn’t boring. Have a great May

Featured Walkthrough | April | How to Add New Pages in WordPress

Market Insights

Last year we started the process of aggregating client data into anonymised reports that allowed us to provide insights into a slice of the market’s ad spend, and subsequent number of conversions and revenue. This was well received, but we want to keep working on how we better deliver insights to our clients.

One way of doing this is to integrate Google Analytics and Google Cloud to better handle larger queries and insights. To do this, we will need to make additions to your Google Tag Manager account to send data from GA4 to Google Cloud - this process will begin in July.

Overall Metrics:

NB: Due to limitations imposed by Google, the data below is only a sample of 20% of total datasets.

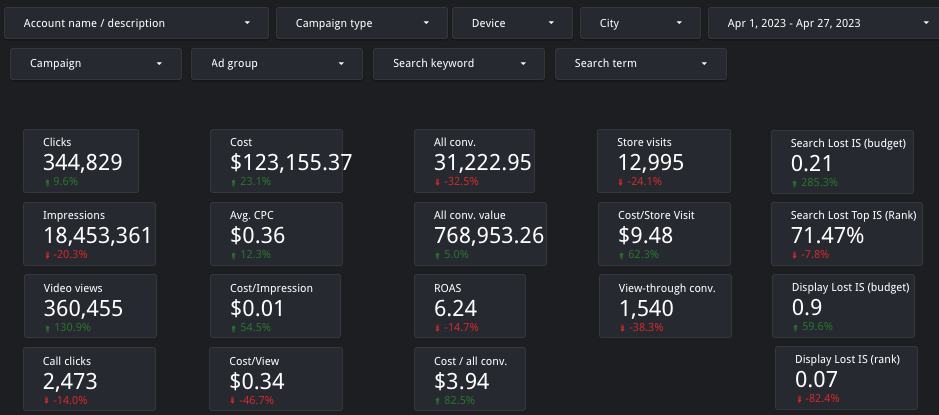

The details below highlight the Google Ads Performance from 1st April 2023 to 27th April 2023.

In comparison to the previous year for the same period, the cost increased by 23.3%, and the average cost per click increased by 12.3%. This is a slight relief in comparison to the steady upward trend we noticed in the Ads cost in the past months.

Overall conversion value (Online Revenue from Ads) only improved by 5% (this was 23.7% in the previous week) and ROAS was at 6.24. This is a drop of 14.7% in April 2022 data.

Store visits have also decreased by 24.1% Year on Year, and the cost per impression for the ads increased by 54.5%. With lower ROAS and increased cost, April 2023 has been the lowest-yielding month for Revenue in 2023 so far.

Return On Ad Spend Metrics

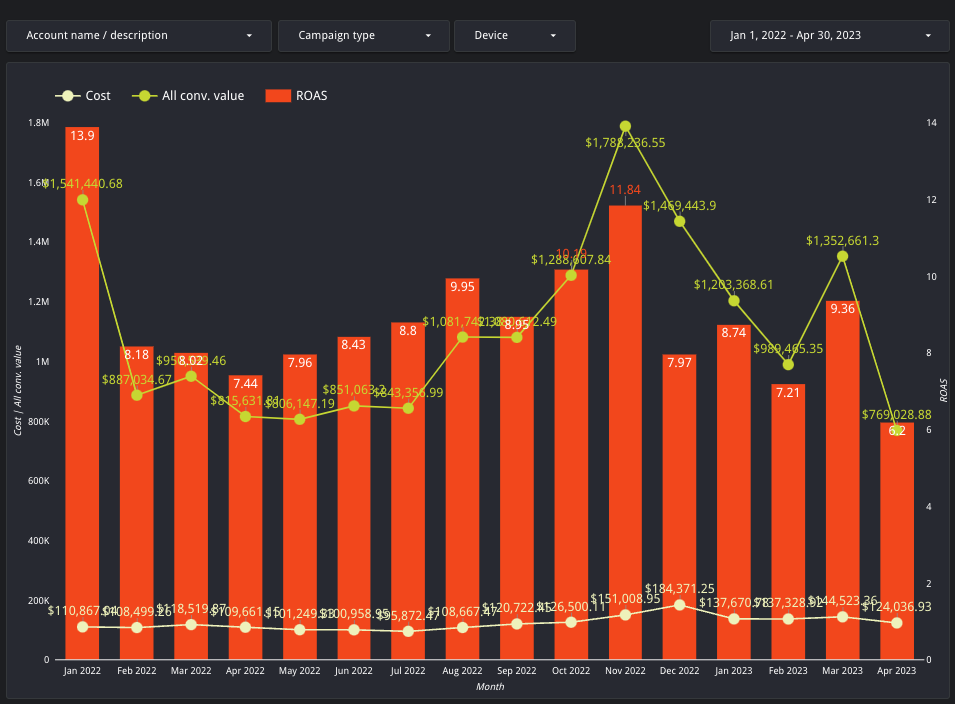

The graph chart below highlights the ROAS trend over the past year.

We noticed an improvement in the ROAS figure in March 2023 (9.36), but April (6.2) indicates the lowest performance in the past 15 months. With Winter approaching, the trend for ROAS appears to be steadily towards the lower end, before it starts to pick up again from July/August onwards, as per the data from the last year.